How to Send Money Through Apple Pay in 2022

Apple Pay is a mobile payment system that allows easy and secure transactions. How can you send money using Apple Pay? We’ll go over how to make payments in stores, how to buy things online without needing your card on hand, how to set up an account if you don’t have one already, how to add cards with the same bank or central banks, how to change your default card when paying with Apple Pay in supported apps and more!

Because there are so many iPhone users, sending them money or asking for cash through Apple Pay may be helpful. But how can you pay someone with Apple Pay?

It may appear strange to send payments to a third party, but once you’ve done it, it’s easy. This guide will show you how to utilize Apple Pay if you haven’t already. Please note that using Apple Pay to pay friends and family members in the United States is only accessible to persons.

How does Apple Pay work, and how can I use it?

Users can make online payments in applications and stores using their mobile devices (and other Apple products). A linked credit, debit, or prepaid card can be used to add funds to your Apple Pay balance. These transactions must be authorized with a passcode, Touch ID, Face ID, or double-click on the side button of your Apple Watch.

With Apple Pay and your Apple Cash balance, you can send and receive money in Messages.

Install the Apple Wallet If You Don’t Have It Yet.

You’ll need the Apple Wallet software on your iOS device to use Apple Pay. After iOS 10 was released, it became possible to get rid of previously installed Apple programs, and the Apple Wallet is no exception. Many users inadvertently erase the wallet app from their phone before ever using it.

We all know that there are a lot of preinstalled applications that we never use, but this one is useful and may make payments more manageable.

If you deleted the Wallet software, go to the apple store and download it again. It’s also worth noting that with Apple Pay, you can only send money to other Apple users; they’ll need the Wallet app installed to receive it.

Add a new payment method

You must first add a payment method to your account to use Apple Pay. Adding a payment method is simple.

Press and hold on to it once you’ve downloaded the Wallet app until a black circle with a plus (+) sign appears. To add new payment methods, tap this. Continue to add a new card by tapping Continue. The Apple Wallet app allows you to scan a debit or credit card and automatically input the information, so you won’t have to type out each number separately.

You may also apply for the Apple Card in the app. The Apple Card is a credit card offered by Goldman Sachs with a fluctuating interest rate. You must have excellent credit, and some fair scores are acceptable to be eligible.

How to Pay Merchants With Apple Pay?

After you’ve added a payment method or two, you’re ready to start paying merchants. Most businesses and even vending machines have Apple Pay integration. You may quickly pay with your phone without pulling out a card.

Double-click the Side button on your iPhone near any Apple Pay contactless reader terminal to pay a merchant using Apple Pay. This will bring up your Apple Pay cards. You may select the Apple card you wish to use, which will go to the top of the list.

After you’ve verified the payment, you’ll hear a sound. If double-clicking the side button doesn’t work for you, check to see whether this option has been enabled. To activate it, go to Settings > Wallet & Apple Pay and allow Double-Click Side Button.

Set Up Apple Cash to Pay Someone Using Apple Pay

You can undoubtedly use Apple Pay to send money to friends and family! They must be in the United States and have an Apple Wallet. You can currently not pay with your Apple Wallet to other bank accounts or alternative payment apps (such as CashApp or Venmo).

You may send money to friends and family using the Messages app. However, only use Apple Pay on the App Store if this payment option is enabled. You’ll need to do one more thing to get this choice—set up Apple Cash. This is a cash wallet within your Apple Wallet that you may load using Apple Pay and receive payments from others. Please note that all recipients of your cheques will require access to Apple Cash.

To configure Apple Cash, open the Wallet app. You’ll see a black card labeled “Cash” in the Wallet app that you need to activate. To set up your Apple Cash account, tap on this. In most situations, the procedure should take you less than a minute. All you have to do is consent to some straightforward information verification.

How To Pay Someone with Apple Cash?

Now that you’ve completed the configuration, you may begin sending and receiving money. There are no further adjustments to make, and everything should work as intended from this point forward.

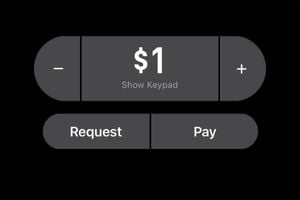

To begin receiving and sending payments, all you have to do is use iMessage. Open the Messages app on your iPhone and tap on the person you want to pay. An Apple Pay symbol will appear on top of the keyboard. You may request or send money with an iMessage after selecting this icon.

You can input the price you wish to transmit or request and send it like a regular message. The receiver will be informed when this is delivered. If there is a problem, you will be notified, and the payment or request will be canceled, so there’s no need to worry.

Send Money Through Siri

You may utilize it for those who use Siri frequently to make or request payments quickly and hands-free. State, “Siri, send [contact name] five dollars,” and it will confirm your payment before sending it. Money requests are the same.

Send Money From Apple Watch

If you want to transfer money using Apple Cash on an Apple Watch, you’ll need to add a debit card to Apple Pay. It would be best if you were prompted to use the same credit card on your paired Apple watch when you create an Apple Pay debit card on your iPhone.

To reply:

- Slide your finger down from the top of the screen and tap Messages.

- Begin a new conversation or resume an existing one by sliding your finger down from the top of the screen.

- Select Apple Pay by swiping down and tapping its icon. Select a monetary amount by touching the plus or minus signs, twisting the Digital Crown, or zeroing in on a single digit with the Digital Crown.

After that, double-press the side button to pay.

How to Withdraw Your Apple Cash?

To withdraw your Apple Cash from the Apple Wallet, go to its settings and choose “Withdraw.” Then click on “Deposit” in the Apple Wallet app. You can send Apple Cash to anybody else by simply saving it in the app. After all, as with any conventional bank, Apple Cash is FDIC-insured, so it’s perfectly safe to keep some money there.

To withdraw your money:

- Open the Apple Wallet app on your device.

- Click on the black Apple Cash card in the lower part of the screen. You may see how much money you have in Apple Cash here.

- Tap the circle with three dots in the upper right corner if you’d want to withdraw.

Here are the Apple Cash settings you’ll need to know. A setting labeled Bank Account may be found on this page. Enter the Bank Account section to add your bank account and input your routing and account numbers.

After you’ve created an Apple Cash profile and verified it, you may choose Transfer to Bank from the top of the page. To submit the transfer, type in the amount and hit Next. This procedure takes one to three days, depending on your bank.

How Apple Pay & Apple Cash Work Together?

- If you wish to pay for something using your Apple Cash balance in a shop, app, or online, choose Apple Cash as the payment choice through Apple Pay.

- If you want to send money in the Messages app, select Apple Pay from the drop-down menu and add funds from your Apple Cash account.

What are the Differences Between Apple Cash and Apple Pay?

- If applicable, Apple Cash can be funded using a debit card, money received via iMessage, or Daily Cash (cashback) from your Apple credit card.

- You can get Apple Pay by loading it on a debit card, credit card, prepaid card, or Apple Cash.

- Although Apple Cash is exclusively linked to the closed system, it is possible to use Apple Pay as a different payment method.

- Apple Cash can only be used with Apple Pay as a payment option.

- You can move your Apple Cash balance to a bank account.

- You can’t move funds from Apple Pay to a bank account.

Why Should I Use Apple Pay or Apple Cash Instead of Venmo or PayPal?

-

Platforms Available:

The mobile payment market is expanding rapidly. Because of this, various payment platforms are accessible. Apple Pay and Apple Cash are only available on iOS devices, whereas Venmo and PayPal are available on Android and iOS smartphones.

-

Costs to transfer money:

It’s free to move money with Apple Cash and Venmo. It costs nothing to send cash using a linked debit card or in-app balance with Apple Cash, but payments made through credit cards are charged at 3% of the amount transferred. Sending money via PayPal’s in-app payment system is free; however, sending funds using your debit or credit card costs 2.9 percent of the total plus 30 cents.

-

Money Transfer speed:

With Apple Pay, you can receive money as an in-app balance that you may then move to a bank account. This transfer might take between three to five business days using Venmo and PayPal, but only up to three days with Apple Cash. Withdrawals are processed instantly through Apple Pay, Venmo, and PayPal; they usually take only a few minutes. All three services charge the same transaction fee of 1.5 percent of the transferred amount, with certain minimums and maximums depending on the service.

-

Insurance Coverage by FDIC:

The FDIC does not insure Apple Cash. When you set up your Apple Cash account, your money is federally guaranteed up to $250,000, just like in a regular bank account. Unless they’re from direct deposits, PayPal and the Venmo app balances aren’t insured by the Federal Deposit Insurance Corp.

-

Money Transfer limits:

Apple Cash’s transaction limits are more significant than those of PayPal and Venmo. You can transfer up to $10,000 per transaction with Apple Cash and up to $20,000 each week through your debit card or bank account, whereas PayPal allows transfers totaling no more than $60,000 per transfer and, in some circumstances, no more than $10,000. Instant transfers to debit cards are limited to a maximum of $5,000 per transfer and week; the same goes for instant bank transfers.

-

Making payments:

You may use Apple Pay (as well as Apple Cash) to pay for items in stores, applications, and websites. In addition, you may apply for the firm’s credit card, the Apple Card, which also interacts with other digital platforms. PayPal and Venmo may be used to make payments online, in apps, and in shops; each has a credit card.

How do you Receive Payments Automatically or Manually?

Apple announced Apple Cash, a new way to pay friends and family online. This payment method allows people to send money directly to each other without having to sign up for a traditional bank account.

You have seven days to accept the money the first time you use this feature. After you accept the terms of use, payments are automatically accepted. Payments are secure and stored safely in Apple Cash. You may instantly deposit the cash into the bank account or load them onto another debit card that is compatible with Apple Pay.

You can set up automatic transfers to ensure you don’t miss out on any money. And if you want to receive money, you can do that too.

How can I Stop Payment or File a Dispute?

You can easily accept or decline the transaction if someone sends you money via Apple Pay. But what happens if you receive a payment request via email or text message? You can either refuse the Payment or ask the sender to cancel it. Here are some things to know about how to do both.

- Open the Messages app, then start a conversation with the person who sent the Payment. Tap the payment option.

- Your Apple Cash card opens up in the Wallet app. Tap the payment icon.

- Tap the Payment and select Accept Payment.

- Under Recent Payments, tap Payment.

- Tap the Payment again to decline the Payment.

- Under Recent Payments, tap the payment. Then tap Cancel Payment.

You can now make payments to friends or obtain money via text conversations after you’ve set up your Apple Wallet. You may also use iMessage to pay individuals who also use iMessage and are in the United States. If you get money delivered, withdrawing it to a bank account makes it simpler to spend your cash outside Apple Pay.

Setting up Apple Pay now can make life more straightforward in the future, and it’s a great way to use your iPhone without having to carry cash.